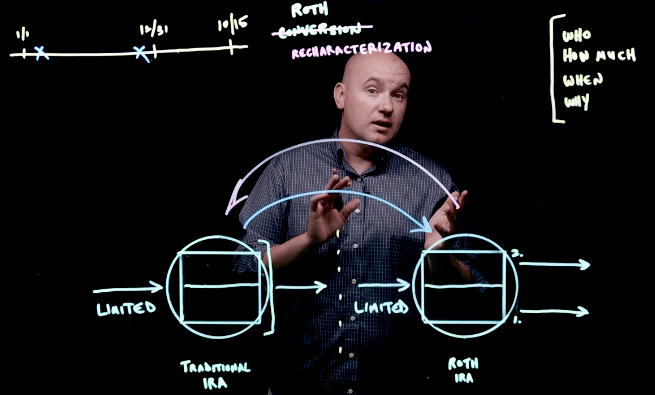

[Video] Recharacterization…The Roth Conversion “Undo” Button

by Stephen Smalenberger, EA / August 14, 2017

STEPHEN SMALENBERGER, EA

Ever wished you could hit the “undo button” and everything would go back to how it was?

Well this does actually exist and in the financial world this is known as a recharacterization. That is a big word that essentially means to unwind or undo a Roth Conversion that was processed at an earlier point in time.

Remember that money may be put into a Roth IRA in two forms:

- Contribution(s)

- Conversion(s)

The conversion which is the shifting of assets (cash and/or investments) from a Traditional IRA to a Roth IRA creates a taxable event. The amount of money leaving the Traditional IRA is considered a taxable distribution/withdrawal.

We shared that there are two important considerations related to a conversion:

- How Much?

- When?

The ability to recharacterize gives you a 10-month plus window (until October 15th of the year following the original conversion) in which to look back and evaluate your decision. Was the original conversion too large and the amount drove you up into a higher tax bracket? Did the market drop after the assets were converted causing you to pay tax at a value larger than exists today?

Being able to look back in the review mirror, see what has happened and then decide if that decision today still makes sense is very unique and creates great planning opportunities.

If you find that the decision back then doesn’t still make sense now, a change can be made. You have the option to choose how much to undo: all which is a full recharacterization or some which is a partial recharacterization.

In summary, here are the important takeaways:

Who?

Anyone that has processed a Roth Conversion has until October 15th of the year following to Recharacterize.

How Much?

You can recharacterize all, some or none. The choice is up to you depending upon your specific goals and circumstances and how things have changed since the conversion was completed.

When?

A Roth Conversion can be processed any time between January 1st and December 31st for that respective Tax Year. The Recharacterization can be processed any time up until October 15th of the year following for that respective conversion.

Why?

A few simple reasons why you may want to recharacterize some or all of a conversion:

- You ended up in a higher tax bracket than desired

- You do not have the funds to pay the tax liability of the conversion

- The Market has dropped and the investments are worth less now than before

- You hedged your bets and processed multiple conversions isolating specific investment holdings

We believe that there is power in laying out a plan since it identifies opportunities that exist and how implanting a strategy will impact you and your family.

As always, there are many considerations and details not addressed in this post. It is meant to be general and educational in nature. However, if this raised a question or prompted curiosity on how various planning strategies could potentially be applied to your particular situation… please let us know. We are happy to help!

Ready to take the next step?

Schedule a quick call with our financial advisors.