Can I Change My Tax Outcome After Year-End?

by Stephen Smalenberger, EA / March 2, 2017Written by: Stephen Smalenberger, EA

It’s that time of year again that is affectionately referred to as “Tax Season.” You may be scheduling a time with your CPA or firing up a tax software on your computer. This may lead you to question what results you’ll find when the return is complete. Will you have a refund or a balance due? If you owe… how much? At this point, can I change my tax outcome after year-end?

There are a few options available depending upon whether you are self-employed or not. Let’s address what can be done after year-end by the general public who do not have their own business.

IRA Contributions

The Internal Revenue Service allows taxpayers who have earned income from a paycheck to make a contribution(s) any time throughout the year. This is allowed up until April 15th of the following year. These contributions can be made into an Individual Retirement Agreement better known as an IRA.

This does depend upon your income level. The money deposited could be recognized either as a tax-deductible contribution or a non-deductible contribution.

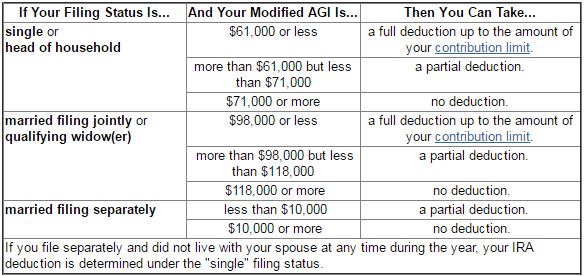

The following is a table from the IRS which provides a summary:

If tax-deductible, the money that goes into this type of account reduces both your Adjusted Gross Income (AGI) and your Taxable Income. This ultimately lowers your taxes due!

If your income for the year, however, exceeds the limits as seen above, a contribution can still be made. You will just not receive the benefit of a tax deduction.

The amount that can be contributed each year is limited by one of two factors: earned income or your age.

For the 2016 Tax Year, those under age 50 could make a maximum contribution of up to $5,500. Those between 50 and 70 1/2 are allowed an additional $1,000 “catch-up” which brings their total maximum contribution up to $6,500 for the year.

Spousal Contributions

Like most areas of tax or finance, there are many rules and sometimes even exceptions. To add another layer of complexity, there is even something called a “Spousal Contribution”. This which allows a working spouse to make contributions on behalf of their non-working spouse. This goes into an IRA owned by that person.

If you are facing sticker shock of a tax balance due and wondering what can be done to reduce it or maybe you are considering ways to save money for retirement in a tax-efficient manner, a contribution to a Traditional IRA may be something for you to consider.

And if you don’t want to be in the same position next year, let’s talk about how we can help you plan ahead.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Strategies for Restricted Stock Unit Taxes [Video]

In this video, we breakdown the types of RSU vesting schedules and different strategies for handling Restricted Stock Unit taxes.

Strategies for Early Retirement Healthcare [Video]

Early retirement healthcare can be tricky. This video explains your health insurance options before age 65 and Medicare.

Stephen Smalenberger, EA

Steve enjoys getting to know clients and hear their unique stories and the lessons learned which has brought them where they are today. One of the reasons he enjoys what he does is the ability to show the outcome that can be achieved with different choices. He also enjoys continually learning.