AbbVie Retirement Income Choice for Employees

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / August 6, 2022

North Chicago-based AbbVie is currently offering employees a new savings option that can significantly affect their retirement income. Employees have until August 26, 2022 to decide whether they want to stay on the current AbbVie retirement plans, or accept a new plan that would freeze their pension benefit but offer higher 401(k) contributions in return. This special blog post can help AbbVie employees assess the offer so they can make an informed decision about their retirement security.

Disclaimer:

All written content on this site is for information purposes only. Opinions expressed herein are solely those of FDS, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

What is AbbVie Retirement Income Choice?

AbbVie has been working to create a new retirement savings plan for new employees starting in 2022. Since these benefits will be substantially different from what they’ve offered in the past, existing employees are being given the option of staying on AbbVie’s old retirement plans, or move to the new one. We’ll get into the details of what that new plan offers in a moment, but first let’s highlight some key facts you need to be aware of:

- The enrollment window opened on July 18, 2022 and runs through August 26, 2022.

- Employees must make their choice by August 26, 2022; They will accept no changes after that date.

- Your choice becomes effective on January 1, 2023.

- A pension & 401(k) simulator is available to AbbVie employees to help them compare their two options.

- AbbVie is agnostic about which option you choose; it’s totally up to you.

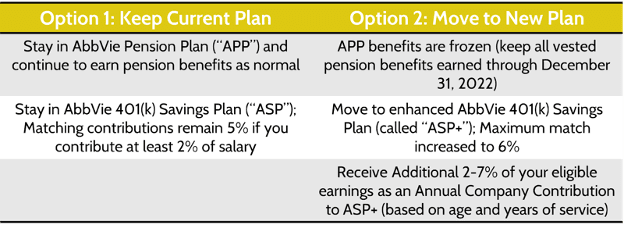

Employees must choose between one of the following two options:

To be very clear, Option 1 means that nothing will change with your pension and 401(k). So if you want to keep what you have, you can! But since Option 2 is offering enhanced 401(k) contribution benefits, it’s important to compare these choices so you can get the most out of AbbVie’s retirement benefits.

We are going to look at each major piece of this offer. First, looking at the pension benefit and second, looking at the changes to the 401(k) program.

Analyzing the Proposed AbbVie Pension Plan Changes

AbbVie’s Pension Plan and Supplement Pension Plan are very attractive retirement benefits for employees, particularly for employees that have worked for the company for a long time. Upon retirement, the employee can elect from a range of payment options as a monthly annuity. For high-level executives with many years of service, the annual pension benefit could be substantial.

Early this year, AbbVie announced it had closed its pension plan to new hires in the U.S. starting January 1, 2022. This follows dozens of large companies that have closed their pensions over the last 20 years. Low interest rates and poor stock market returns have made the cost of running pensions prohibitively high for these companies. AbbVie’s Retirement Income Choice is the company’s way of making up for the fact that new hires are no longer eligible for the pension.

What’s the impact of freezing your pension benefit? Pension calculations are notoriously complex and depend on many factors, such as:

- Salary & bonuses

- Age

- Years of service at AbbVie

- Expected retirement date

- Age that you’d begin your pension benefit

The best way to see the potential impact on your pension benefit is to log on to the AbbVie simulator that’s part of the Retirement Income Choice program. There, you can input assumptions such as those seen above and the system will tell you what your benefit would be if you stayed in Option 1 or switched to Option 2.

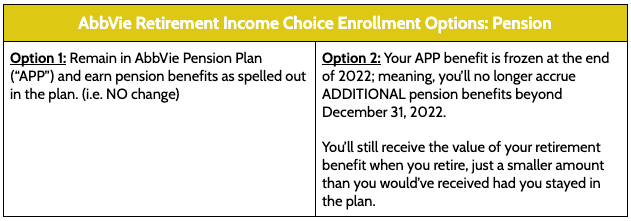

The simulator gives you a good side-by-side comparison of what your monthly retirement annuity income stream would be under Option 1 (stay in program) and Option 2 (elect new program and have pension benefits frozen.)

How would choosing Option 2 and freezing your pension benefit impact you? It’s hard to give exact numbers, which is why it’s important to log in and run your personalized calculations in the simulator AbbVie provides you.

Roughly speaking, the impact of freezing your pension by choosing Option 2 would reduce your monthly pension annuity benefit by 20% or more. That’s important to think about. Remember, this pension annuity income would start when you elect to receive it at retirement and last for the rest of your life and the life of your spouse, if you chose a “Joint & Survivor” option.

Because of the significant pension income reduction you’d face if you Choose Option 2, AbbVie has enhanced 401(k) contributions, as we see below.

Analyzing the Proposed AbbVie Savings Plan 401(k) Changes

We’ve seen that choosing Option 2 and freezing your pension benefit can lead to a meaningfully lower pension retirement benefit. So what is AbbVie offering as an offset?

In exchange for a lower pension, AbbVie is offering enhanced 401(k) benefits to anyone that chooses Option 2.

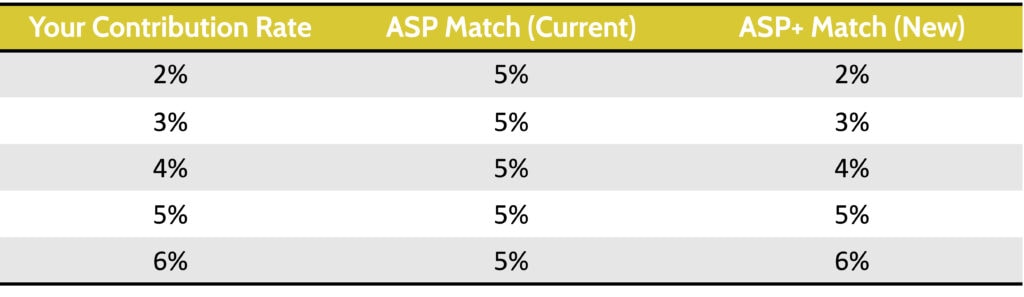

The first enhancement is an increase in the maximum company matching contribution to your 401(k). The current AbbVie Savings Plan (“ASP”) offers a 5% matching contribution to anyone contributing at least 2% of their salary to the 401(k). That’s not bad. You put in $2 and AbbVie gives you $5.

The new & enhanced AbbVie Savings Program Plus (“ASP+”) would increase the maximum match to 6%. But the only way to get that extra 1% match is if you’re contributing at least 6%, as we show here.

You can see here that for anyone contributing between 2% and 4% of their salary, they’d get a higher match in the current ASP program versus the new ASP+ plan. At a 5% contribution rate you get the same match amount in either plan. It’s only if you’re contributing 6% or more that you get a higher matching contribution in the ASP+ plan.

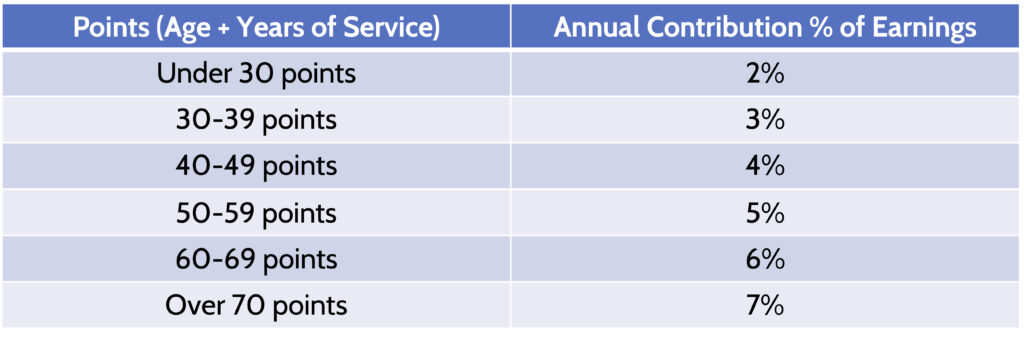

That doesn’t sound like a great deal, but there’s another important enhancement that makes the ASP+ program more attractive: an Annual Company Contribution based on your age plus years of service.

Depending on how old you are and how long you’ve worked at AbbVie, you’ll get an additional 2% to 7% of your salary deposited into your 401(k) each year. They would make these deposits once per year and put the deposit into your account early in the new year.

AbbVie is using a points system to determine how much you’d get. It works like this:

Your Age + Years of Service at AbbVie = Points

You then match your points to the table below to see how much of your eligible earnings AbbVie will give you each year as part of the Annual Company Contribution.

For example, if you’re 30 years old and have worked at AbbVie for 5 years, you’d have 35 points which would entitle you to a 3% annual contribution. If you’re 40 years old and have worked at AbbVie for 15 years, then you’d have 55 points and get a 5% contribution. Put another way, each year you work for AbbVie you get 2 more points.

Which Option Should I Choose?

As the disclaimer at the beginning of this post says, we here hope to give you information. It’s impossible for us to recommend one choice over another without knowing your situation in detail, so we’re not recommending anything. That’s why it’s so important to run your own simulation at AbbVie.

But sometimes it’s good to know what cases you should think about as you get ready to make your choice.

Example: The Young Job Hopper. If you’re relatively early in your career and like to change jobs often, then the new choices offered in Option 2 may appeal to you. The additional matching contributions and annual 401(k) contribution made by AbbVie under ASP+ would likely have long-term value. You have to work 5 years at AbbVie to be 100% vested in the annual contributions. But higher 401(k) contributions would be yours to keep while any pension earned during a short stint at AbbVie would likely not amount to much, if anything.

Example: The Super Saver. The AbbVie Savings Plan is unique because it allows employees to pursue a Mega Backdoor Roth strategy. This is where you make after-tax contributions to the 401(k) plan and then convert those contributions to a Roth IRA. There is a limit how much can go into your 401(k) per year. That limit is currently $61,000. If you’re pursuing the Mega Backdoor Roth strategy at AbbVie, it may make sense to stay in Option 1. The reason is that the extra annual contribution made by AbbVie in the new ASP+ plan would reduce the maximum amount of after-tax contributions you could make.

Example: The Long-time AbbVie Employee Nearing Retirement. If you’ve worked at AbbVie a long time, then you definitely want to be careful with your choice. Giving up a portion of a potentially large pension benefit by choosing Option 2 could be costly. Why? Many people will be in retirement for 25+ years. As we saw above, choosing to freeze your pension could reduce your monthly pension by 20% or more. And that lost income would be compounded over the life of your retirement. That’s a lot! Higher 401(k) contributions under ASP+ would offset some of that, but probably not all of it. Be careful!

Summing up, it’s important to think about your future career at AbbVie. Younger people who don’t expect to work at AbbVie the rest of their lives may find more value in the new plans under Option 2. But if you’re older or have worked at AbbVie for many years, then you want to be careful in giving up your existing pension and 401(k) benefits.

Financial Design Studio Helps AbbVie Executives

At Financial Design Studio, we specialize in helping corporate executives navigate all the benefits they’re entitled to. Stock options, restricted stock units, deferred compensation, pension, and 401(k) savings plans exist to help you create long-term wealth. But they can be confusing.

If you’re looking at your options under AbbVie’s Retirement Income Choice and aren’t sure which option to choose, you can reach out to us to see how we can help. Given the short time frame before the August 26, 2022 deadline, we’re helping AbbVie employees on a first-come, first-serve basis.

For AbbVie employees who are within 10 years of retirement, we also offer comprehensive retirement planning. The 10 years before your retirement are some of the most important as there are financial planning strategies that can save you taxes over the long-run. And given how strong AbbVie’s current retirement benefits are, you may even be closer to being able to retire than you currently imagine!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Choose Open Enrollment Benefits

Open enrollment season is almost here! It's time to get familiar with all the benefits your company offers you this year. Our guide will help you understand the most common open enrollment benefit options, and how best to choose open enrollment benefits.

Everything to Know About Health Savings Accounts

Health Savings Accounts have been around for 20 years but are often misunderstood and underutilized. HSAs are powerful savings tools to cover future medical expenses, such as long-term care, or to help fund healthcare for early retirees. We explain everything you need to know about health savings accounts: what they are, how contribute to them,...

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.