[Video] Why Your Business Number’s Plan Matters

by Financial Design Studio, Inc. / December 5, 2018MICHELLE SMALENBERGER, CFP ®

In a previous video we’ve talked about keeping the books for your business up to date, including all your income and expenses.

Today, we’ll talk about why that matters. Here’s a progression of your business from when you start to the growth mode that you find yourself in. In the beginning you’re simply trying to get revenue in the door. Now that you’re earning revenue you find yourself trying to break-even so that your income can pay for all the business expenses.

A new goal becomes earning enough to receive a regular paycheck. Finally, since you have regular income to provide a paycheck to yourself you need to consider whether to reinvest excess revenue back into the business or invest in your own personal finances through starting a retirement account or funding other goals.

Now your thought process changes so you consider the progress of your business and progress toward your personal goals. If you always keep your financials up to date they you can make decisions quicker about where to place your income as it comes.

If you don’t set a plan to purposefully progress toward something then you may find you never reach what you hoped to.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Retirement Saving Strategies for High Income Earners [Video + Free PDF]

One of the most common questions we get from high earning business owners and corporate executives is: how can I be saving more money for retirement? Here are several options to consider, along with a video and free PDF guide.

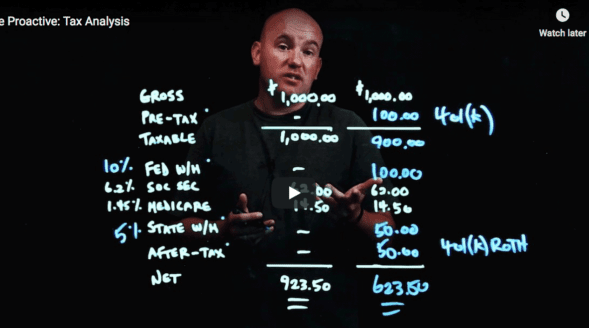

Be Proactive: Tax Analysis [Video]

One question we hear a lot from those who are self-employed and doing some type of payroll is: “How do I balance my taxes and save for the future?” For this let’s discuss your tax analysis… Let’s go through an example so I can show you some of the mechanics of how a…

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.