Video

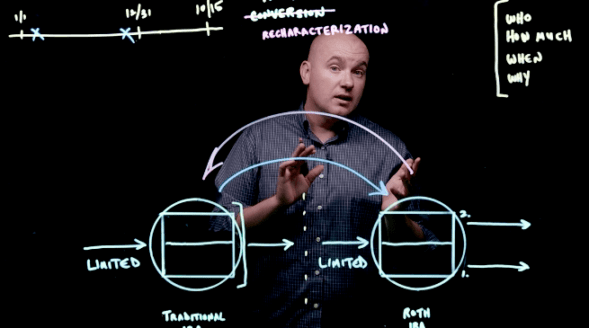

[Video] Recharacterization…The Roth Conversion “Undo” Button

STEPHEN SMALENBERGER, EA Ever wished you could hit the “undo button” and everything would go back to how it was? Well this does actually exist and in the financial world this is known as a recharacterization. That is a big word that essentially means to unwind or undo a Roth Conversion that was processed at…

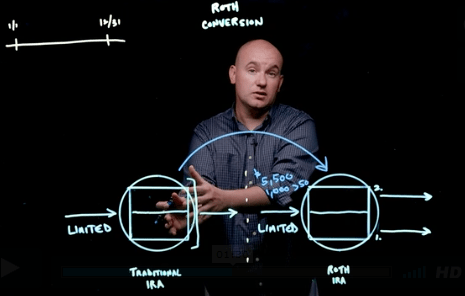

[Video] Roth Conversions: What Are They & How Do They Work?

STEPHEN SMALENBERGER, EA We want to introduce a design element that we like to use in financial plans, when it makes sense. And this strategy is known as the Roth Conversion. Money may be put into a Roth IRA in two forms: Contribution(s) Conversion(s) As explained in prior articles and videos, the Roth IRA contributions…

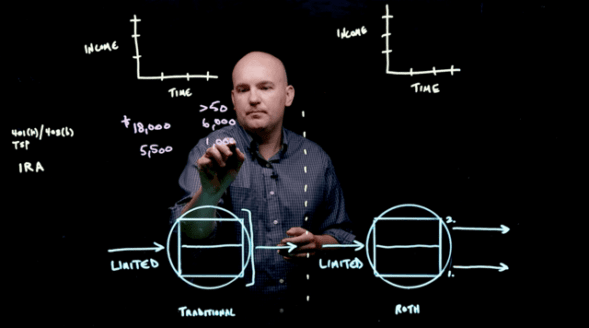

Traditional IRA/401(k) & Roth IRA/401(k) Which is best? [Video]

How do you decide between a Traditional IRA/401(k) & Roth IRA/401(k)? In a prior video we talked about the three different types of account registrations to decide between when saving: Taxable, Tax-Deferred, and Tax-Free. Let’s focus on tax deferred and tax free. Both of those are retirement focused so let’s walk through how much you…

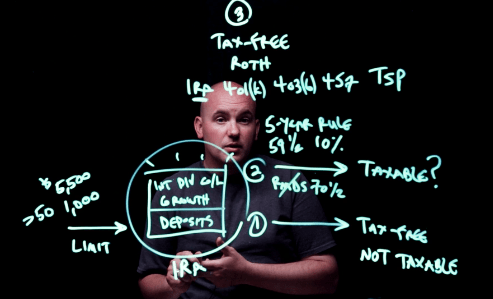

[Video] How Tax-Free Accounts Work

STEPHEN SMALENBERGER, EA There are only three types of accounts: Taxable Tax-Deferred Tax-Free We focused on the first two types already. Let’s focus on the last, Tax-Free. The accounts in this registration category include the following: Roth IRA Roth 401(k) Roth 403(b) Roth 457 Roth Thrift Savings Plan (TSP) The word Roth is really important…

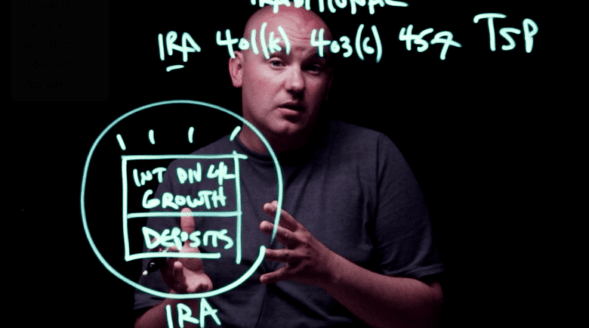

[Video] How Tax-Deferred Accounts Work

STEPHEN SMALENBERGER, EA There are only three types of accounts: Taxable Tax-Deferred Tax-Free We focused on the Taxable accounts last time. Let’s jump in now and look at the second, Tax-Deferred. The accounts in this registration category include the following: Traditional IRA Traditional 401(k) Traditional 403(b) Traditional 457 Thrift Savings Plan The movement of money…

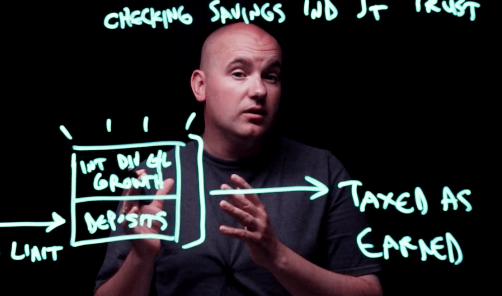

[Video] How Taxable Accounts Work

STEPHEN SMALENBERGER, EA There are only three types of accounts: Taxable Tax-Deferred Tax-Free Let’s jump in and look at the first, Taxable. The accounts in this registration category include the following: Checking Savings Individual Joint Trust The movement of money within the type of account is seen below: Who are…