Tax-Deferred

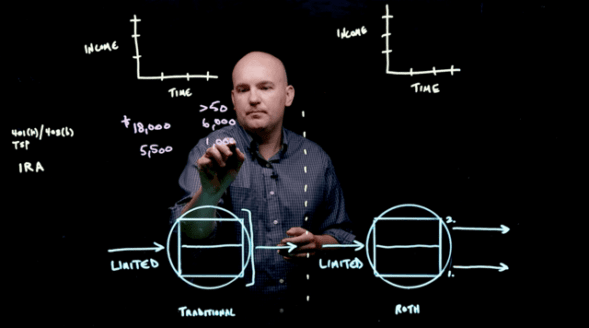

Traditional IRA/401(k) & Roth IRA/401(k) Which is best? [Video]

How do you decide between a Traditional IRA/401(k) & Roth IRA/401(k)? In a prior video we talked about the three different types of account registrations to decide between when saving: Taxable, Tax-Deferred, and Tax-Free. Let’s focus on tax deferred and tax free. Both of those are retirement focused so let’s walk through how much you…

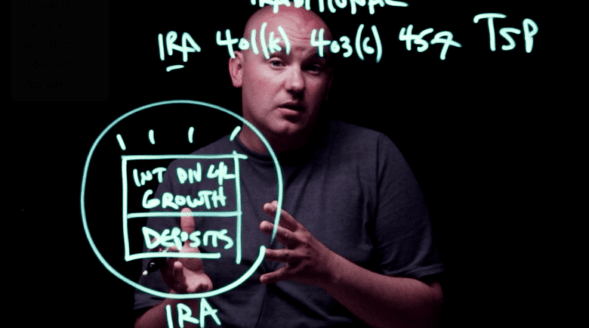

[Video] How Tax-Deferred Accounts Work

STEPHEN SMALENBERGER, EA There are only three types of accounts: Taxable Tax-Deferred Tax-Free We focused on the Taxable accounts last time. Let’s jump in now and look at the second, Tax-Deferred. The accounts in this registration category include the following: Traditional IRA Traditional 401(k) Traditional 403(b) Traditional 457 Thrift Savings Plan The movement of money…

What’s In Your Toolbox? (Part 3)

In the last blog entry What’s In Your Toolbox? (Part 2), we learned about the various types of taxable accounts and how the investment growth is taxed when earned. Let’s turn our attention, today, to the next group of accounts in order to better understand the value these bring to our “toolbox” of options….