[Video] What Is A Diversified Portfolio?

by Michelle Smalenberger, CFP® / June 2, 2017MICHELLE SMALENBERGER CFP®

In many of our Friday Financial Updates, I keep referring to keeping a diversified portfolio strategy, even in light of what’s happening in the markets. So today I want to take some time to really dig in to what that means. What is involved in creating a portfolio, and why being diversified is necessary.

First, what does it mean to have a diversified portfolio? The definition of this is investing in different asset classes and many different securities, in an attempt to reduce overall portfolio risk, and avoid damaging a portfolio’s performance by the poor performance of a single security, industry, or even country.

So what’s involved in creating a portfolio? There’s a few things that you want to keep in mind when you’re thinking of how you should be investing. First, you want to think through your risk tolerance. Can you stomach a change in your portfolio’s value because of things happening in the market? Second, what’s the order of when I should invest? Am I just starting out, am I just starting a career and now have extra funds to invest beyond my 401k, or am I towards retirement, and now I’m looking at how to preserve what I have in my portfolio? And so lastly, this brings us to our investment allocation. Really creating a mix of the right asset classes and percentages of the assets within them, so that we have the best portfolio for you.

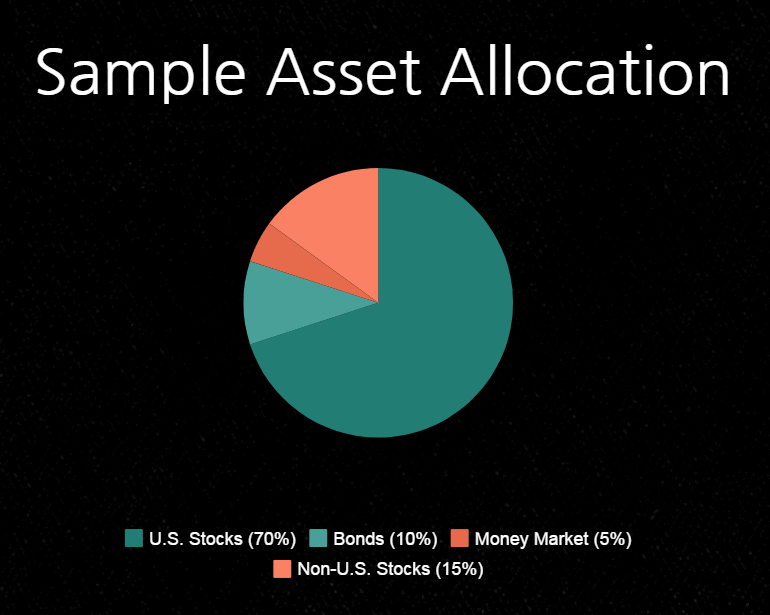

Here are some examples of different combinations of portfolios depending on where you may be. This is definitely not an example of one that any person should use, so you really want to be sure to talk with a financial advisor. However, this is just an example of how you would want to look at the different asset classes and the percentage of the funds you’re going to be investing overall, so that it’s matching the risk that you’re willing to take.

The main reason why you want to have a diversified portfolio is because not every asset class performs the best every year. I want to show you an example of a chart going back to 1997, through 2016. So we’re looking at almost the last twenty years. And as you can see in this example, not one asset class performed the best every year, all the time. Or even if it’s in the first, it’s not necessarily in the second or third the next year.

So it’s really important that we keep a diversified portfolio, so that when they are performing the best, we have a part of our portfolio in various asset classes. So having a diversified portfolio helps you not to lose in the short term, but rather to win in the long term.

Another point about this chart is we’re really looking back at 19-20 years. However, an average investor who’s maybe starting out just after college and has their first job, may be investing for 30-40 years. So this is really even just a short-term picture in the grand scheme of how long someone might be investing.

Another point about this chart is we’re really looking back at 19-20 years. However, an average investor who’s maybe starting out just after college and has their first job, may be investing for 30-40 years. So this is really even just a short-term picture in the grand scheme of how long someone might be investing.

So to help make sure you understand having a diversified portfolio may not allow you to win and double your returns in the first five years, but that you’re really trying to create a winning strategy for the long term of all your investing years.

And as always, if you still have questions, or you need help in creating a portfolio for you, we’d love to help you and we’re happy to have a conversation.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Impactful Giving: Tax Strategies and Vetting Charities [Video]

We all want to make a difference with impactful giving. In this video, find out how to evaluate charities and employ tax-efficient strategies.

Michelle Smalenberger, CFP®

I have a passion for helping others develop a path to financial success! Through different lenses on your financial picture, I want to help create solutions with you that are thoughtful of today and the future. I have seen in my life the power of having a financial plan while making slight changes of direction from time to time. I believe you can experience freedom from anxiety and even excitement when you know your finances are on track.