What A Difference A Day Makes

by Michelle Smalenberger, CFP® / November 4, 2017What A Difference A Day Makes

This last week brought many news headlines. One day in particular, Thursday, Nov. 3rd, brought many of those headlines. Let’s look into these stories to understand how our portfolios will be affected.

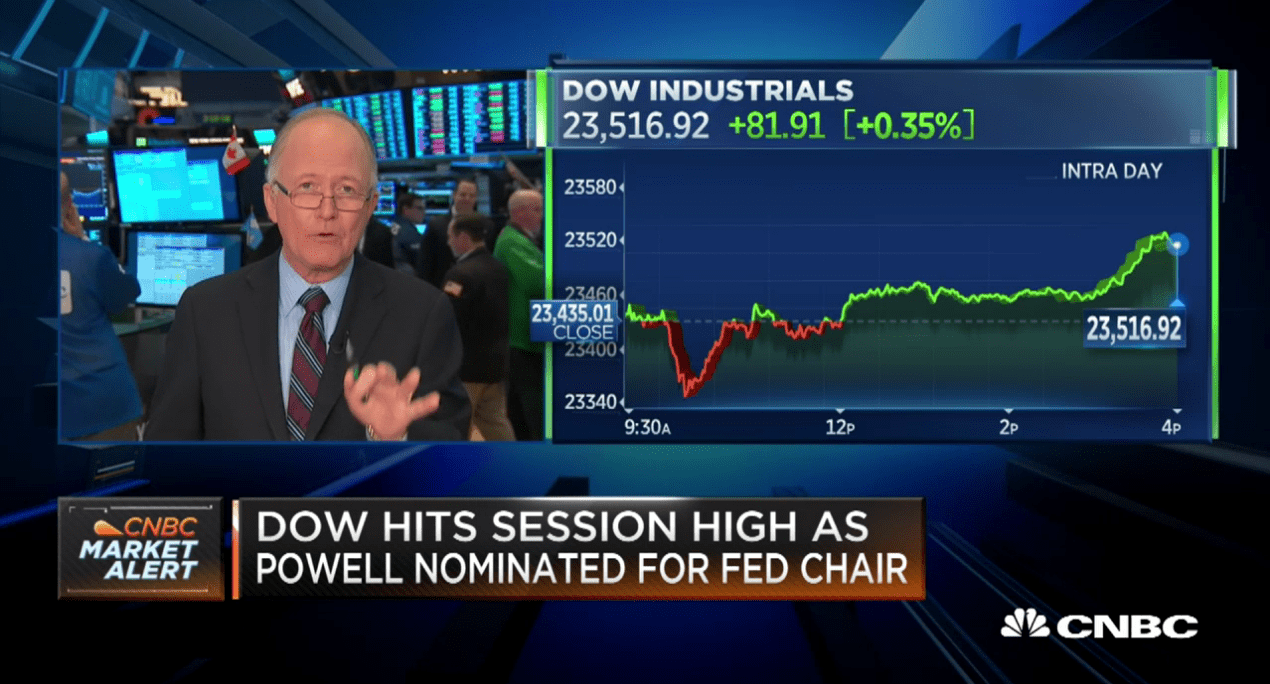

Fed Governor Jerome Powell nominated as Federal Reserve Chair

Mr. Powell is expected to largely follow in the same direction that Ms. Yellen has during her time as the Fed Chair. Many have said that his past experience should serve to help him in this position. He supports the actions already started such as gradual increases in interest rates and gradual declines of the balance sheet. He also believes in decreasing bank regulation.

You can read more about Mr. Powell at the following link, should he be accepted by the Senate. He would start his term in February when Ms. Yellen’s term ends.

Apple Earnings Beat Estimates

There is typically quite a buzz regarding Apple Corp’s earnings. This company has quite a following for their products but also for their stock. Here you can read the summary of their earnings report which surprised many with their increased sales of apple watches. Many have responded positively to the new iPhone X in reviews of the product and now will expect higher sales in the coming holiday season.

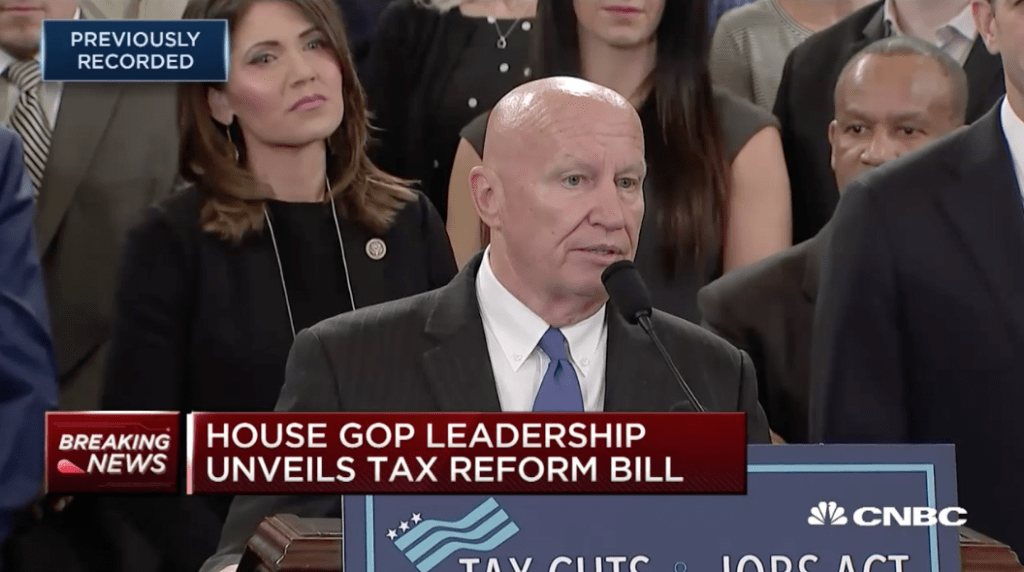

The GOP released the details for the much anticipated Tax Cuts & Jobs Act

The details for the GOP’s long awaited tax plan have finally been revealed. You can read about the details at this link. Many of the provisions that we have been hearing about were accounted for in the plan. Some of these include:

The details for the GOP’s long awaited tax plan have finally been revealed. You can read about the details at this link. Many of the provisions that we have been hearing about were accounted for in the plan. Some of these include:

- Tax Repatriation for corporations with profits overseas at the following lower levels: 12% for cash, 5% for other assets

- Change of tax rates and simplifying from 7 brackets to 4 brackets

- Increase in standard deduction so many households can file their return on a postcard

- Decrease in the amount of a mortgage that can be deducted for new home purchases

There were many additional items in this bill that will no doubt be debated over the coming weeks. One detail that many are asking is how these tax reductions and changes will be paid for.

In light of the clarity we’ve gained in one day how do you invest?

In short, the answer is to keep your diversified portfolio. We still have to wait and see what the final version of the bill will be and when it is passed as legislation. Also, given many changes such as any tax cuts enacted and the continued growth of companies and our economy the Fed may have to change course to combat inflation sooner than expected. With so many changes it is best to keep your diversified portfolio in tact rather than make quick, reactive updates.

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Michelle Smalenberger, CFP®

I have a passion for helping others develop a path to financial success! Through different lenses on your financial picture, I want to help create solutions with you that are thoughtful of today and the future. I have seen in my life the power of having a financial plan while making slight changes of direction from time to time. I believe you can experience freedom from anxiety and even excitement when you know your finances are on track.