What’s In Your Toolbox? (Part 4)

by Stephen Smalenberger, EA / April 12, 2017Over the last several blog entries, we have reviewed the details within the various types of accounts and learned how and when they are taxed.

To finish this series, let’s look at the final grouping:

- Taxable

- Tax-Deferred

- Tax-Free

The Roth IRA was named after William Roth, a senator from the state of Delaware. He was the main legislative sponsor of the bill that became part of the Taxpayer Relief Act of 1997. Once it became law, individuals were able to save money into a new type of account which was completely tax-free.

The accounts are funded by money that has already been taxed, enjoys tax-free growth, and at later point in time when money is pulled from the account(s), experiences no tax implications.

In addition, unlike the tax-deferred accounts that have an eventual point when money needs to be withdrawn (Required Minimum Distribution start at age 70 ½) according to current tax law, these accounts will not be restricted to this rule.

Deposit

The funding of the tax-free accounts is done on a post-tax or commonly referenced as after-tax basis.

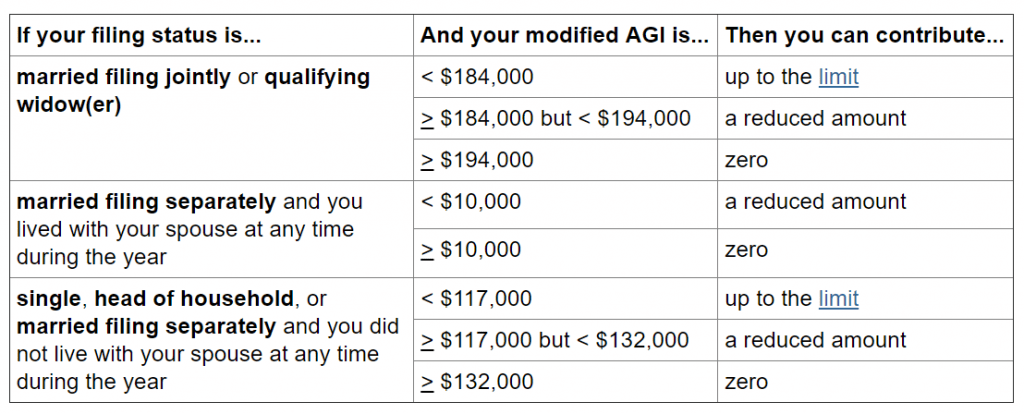

Just like the Traditional IRA, any money deposited into a Roth IRA is known as a “contribution.” It is subject to annual contribution limits based upon age, earned income and income levels. However, depending upon income levels, individuals may be precluded from making any Roth IRA contributions.

And if you are able to make a contribution, this will not generate a tax deduction.

Although there are no age-based restrictions, an account can only be opened and funded for those who have earned income or are the spouse of one who does.

Many companies that provide a Traditional 401(k) benefit to their employees are now also offering a Roth version as an option. The employees would elect to have a specified amount or percentage deducted from their paycheck and have it deposited into a Roth 401(k) or Roth 403(b) account in their name.

In addition to contributions or payroll deferral, there is a third option for funding the Roth accounts which is called a “Roth Conversion.” This is essentially the changing or converting of the location of funds or investments from a tax-deferred account to a tax-free account. The tax is paid at your current rate for the money that leaves the account but then enjoys tax-free growth thereafter. There are a number of strategies surrounding what and when to convert based upon market conditions and your personal financial situation. I’ll touch on this in future blog posts.

Investment Growth

Money within a Roth account may be invested in the market into such things as stocks, bonds, mutual funds and ETFs. As the underlying investments grow, so does the account.

Since the accounts did not experience a tax benefit when the contribution or payroll deferral was made, they will neither feel the tax bite when funds are eventually taken from the account also known as “withdrawals” or “distributions.”

A tax-free account does not incur tax on the growth in the year earned and if in accordance with specific distribution rules, it will not when withdrawn either.

Withdrawals

All contributions into a Roth IRA are eligible to be taken at any point in time for any reason. Basically, what you put in you can take out. No questions asked. There are some specific rules that need to be followed with the growth, though. Tax and/or penalties may be assessed if growth money is taken before age 59 ½ or if the account has not be established five years. The distribution rules can get in-depth so I will handle these separately and in more detail in a later blog post.

As a summary, here’s a table of the main points that we have covered between the various accounts:

| Taxable | Tax-Deferred | Tax-Free | |

|---|---|---|---|

| Can anyone set up an account? | Yes | No | No |

| Deposit limits? | No Limit | Yes | Yes |

| When is the account taxed? | As Earned | When Withdrawn | Never |

| Withdrawal restrictions? | No | Yes | Yes |

I hope that you have found these articles helpful in understanding the “tools” that you could have in your portfolio and why it is great to have a variety to choose from to accomplish your goals. Each one is different, unique and creates advantages in how it’s used.

If you’d like to go back and read through this series again, please see the links below:

- What’s In Your Toolbox?

- What’s In Your Toolbox? (Part 2) Taxable

- What’s In Your Toolbox? (Part 3) Tax-Deferred

- What’s In Your Toolbox? (Part 4) Tax-Free

In the future, I will discuss various ways you can use each account or a combination of these accounts to reach your goals. If you have any questions about anything you read, please let me know!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Strategies for Restricted Stock Unit Taxes [Video]

In this video, we breakdown the types of RSU vesting schedules and different strategies for handling Restricted Stock Unit taxes.

Strategies for Early Retirement Healthcare [Video]

Early retirement healthcare can be tricky. This video explains your health insurance options before age 65 and Medicare.

Stephen Smalenberger, EA

Steve enjoys getting to know clients and hear their unique stories and the lessons learned which has brought them where they are today. One of the reasons he enjoys what he does is the ability to show the outcome that can be achieved with different choices. He also enjoys continually learning.