Keeping Watch On Interest Rates, Trade Tension, & Government Shutdown

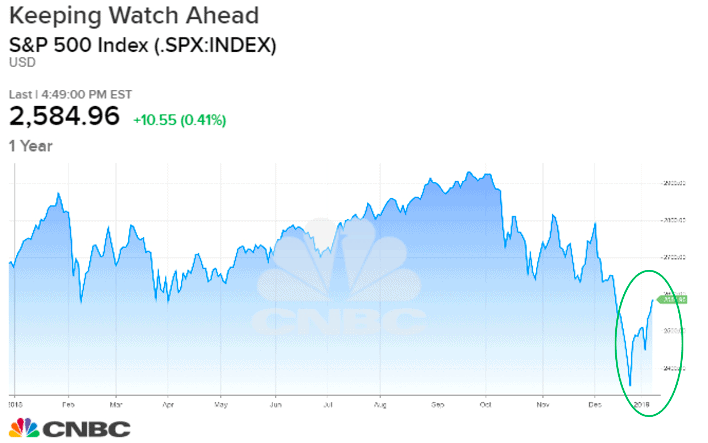

by Financial Design Studio, Inc. / January 10, 2019We’ve seen an encouraging week that has witnessed the market making positive strides forward! This progress is encouraging. Let’s discuss a number of items we are paying attention that can affect how the market moves in the coming days.

Global Trade Tension:

This item alone holds so much potential for higher market movement. Whatever description you give to this trade disagreement between the United States and China the impact is still the same on the two countries and many companies. Tariffs in place have impacted businesses which we are beginning to see in quarterly earning adjustments for the past quarter and the quarters ahead. The big unknown with this issue is the length of time it will continue. So the real impact won’t be known until we are able to see any type of real agreement in sight.

Interest Rates:

The biggest issue bringing down performance in 2018 was the increase in interest rates back to neutral. After the 2008 financial crisis came, the Fed lowered rates to help individuals and the economy get back on track. The thinking was that by doing so, the economy would recover faster. So in 2017 and 2018 the Fed started to raise rates higher, since the economy had shown many signs of improvement. The market saw a problem with the speed they were raising rates though. It appeared the Fed wanted to get them back to neutral quickly, even if it meant the economy might lose some progress made.

Now, in 2019, we have seen the Fed begin to express that they will be patient to make sure the economy is ready for higher rates. They have stated that they are getting close(r) to the neutral rate they want to keep interest rates at, therefore not requiring as many increases this year. So this issue at the time being has brought praise from investors.

Government Shutdown:

Our government has now been shut down for a record number of days. If it continues past this Saturday it will mark the longest shutdown surpassing the last record of 21 days. We wouldn’t be surprised if a new record is set either. While a new record is in sight, it doesn’t necessarily seem to be grabbing all the headlines. Of course none of us want a shutdown with many out of work for an unknown length of time. But we are not hearing much uproar that it’s happening aside from the occasional story in the news.

You may even recall our thoughts after the midterm elections that this kind of gridlock was expected as the newly elected took their offices.

So where do we go from here?

- We are looking for progress on Global Trade. After Wednesday’s meeting we will see if anything worthwhile came forward to get optimistic about.

- We will begin to watch corporate earnings for any large, unexpected misses of earnings that haven’t already been revised lower.

- We will continue to listen to the tone the Fed is setting for interest rates ahead.

We will keep you updated as we move ahead in the New Year!

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.