Traditional IRA/401(k) & Roth IRA/401(k) Which is best? [Video]

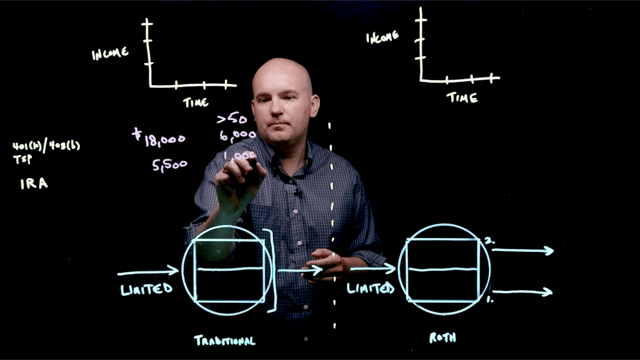

by Stephen Smalenberger, EA / August 1, 2017How do you decide between a Traditional IRA/401(k) & Roth IRA/401(k)? In a prior video we talked about the three different types of account registrations to decide between when saving: Taxable, Tax-Deferred, and Tax-Free. Let’s focus on tax deferred and tax free. Both of those are retirement focused so let’s walk through how much you can put in, when you can put it in, and the benefits of doing so.

How To Decide Between A Traditional IRA/401(k) & Roth IRA/401(k)?

With Tax-Deferred contributions there are annual limits:

- Traditional 401(k), 403(b): You can put in $19,500, plus an additional catch-up of $6,500 if you are over 50 years old.

- Traditional IRA: You can put in $6,000, plus an additional catch-up of $1,000 if you are over 50 years old.

With the Tax-Free contributions there are also annual limits along with income limits:

- Roth 401(k), 403(b): You can put in $19,500, plus an additional catch-up of $6,500 if you are over 50 years old.

- Roth IRA: You can put in $6,000, plus an additional catch-up of $1,000 if you are over 50 years old.

These are both different than taxable accounts where there aren’t any limitations on how much you can put in or take out.

Taking a step back to look at these, the amounts you can contribute are the same, so there’s no benefit between the two in this area. So then why would you want to put money into a Tax-Deferred (Traditional) versus a Tax-Free (Roth) account?

This really depends on your situation. First, look at your income and how you expect that to be over your career.

If you’re a high earner now and then in the future, maybe retirement, it levels off or reduces you may focus your contributions into the Tax-Deferred (Traditional 401(k) or IRA) because you want the benefit of reducing taxable income in these higher earning years.

If you’re starting off your career right now with lower income than you expect in future years then the benefit of a Tax-Deferred contribution into a 401(k) or IRA wouldn’t be as high. So you could make contributions into a Tax-Free (Roth 401(k) or IRA). Then when the money comes out the funds are tax-free.

In summary, when would you choose Tax-Deferred over Tax-Free?

With Traditional 401(k) or IRAs these may work best for a high earner in a high tax bracket, so you can get the benefit now of lowering your taxable income. Your funds are also growing tax-deferred so later when withdrawn it will be taxable, but you got the benefit of lower taxes in earlier years.

With a Roth 401(k) or IRA while you are in early years of your career earning less than you will in the future, it can make sense to contribute to a Roth account and receive tax-free growth now.

There are a lot of decisions to make and one of these accounts or some combination of the two may make sense for you. We’ve seen people miss opportunities along the way. If you feel working with us, laying out a plan and looking at the numbers to make an educated decision would be beneficial, please let us know we are happy to help you!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Find College Scholarships [Video]

In this video, we break down how to find college scholarships for athletics, academics, geography, merit, and more!

Podcast Episode 36: How to Set Your Kids Up For Success

In this episode, we interview Anna Lewis as she shares the opportunities her parents gave her and how they shaped who she became.

Stephen Smalenberger, EA

Steve enjoys getting to know clients and hear their unique stories and the lessons learned which has brought them where they are today. One of the reasons he enjoys what he does is the ability to show the outcome that can be achieved with different choices. He also enjoys continually learning.