Buying Quality: A Good Company vs. A Good Stock

by Financial Design Studio, Inc. / July 4, 2018Buying Quality: A Good Company vs. A Good Stock

We’ve talked about buying quality holdings to hold for the long-term. Especially during a market like we are currently seeing with the war of words and talk of tariffs on additional products. We discussed the importance of buying quality stocks in our post about financial shortcuts last week. The question then is what is a good stock? But, a good company doesn’t necessarily mean the stock of that company is good too.

As you continue to invest you may find it natural to invest in the stock of those companies you buy products from. But let’s consider popular companies that haven’t always been quality investments over the years.

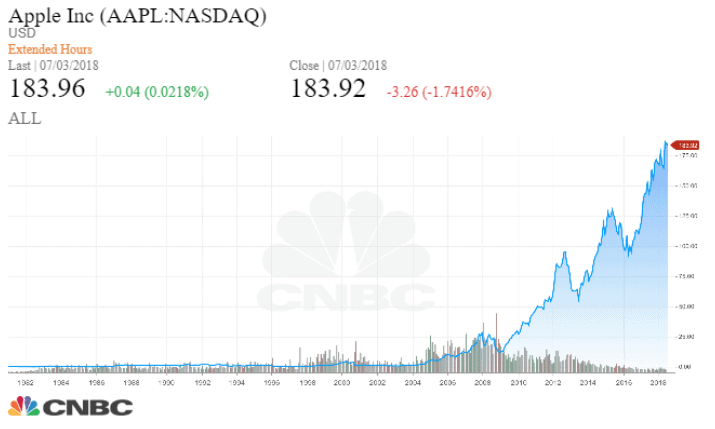

Apple Inc. seems an appropriate company to discuss. In today’s market many would say this is a stock that’s a core holding in their portfolio. They plan to hold it for the long-term. Today they pay a dividend, but that hasn’t always been the case. The profits generated by this company and the cash they keep on their balance sheet provides stability for the company and also for investors. Factors such as corporate profit and the balance sheet which explain their cash flow, assets, and liabilities provide a lot of insight into the financial health of a company. If a company’s financial health doesn’t appear to be on solid footing or improving you may think twice about owning it’s stock. Even during the success of Apple Inc.’s stock you can see there were dips lower in the stock value where investors questioned if the stock was still worth holding.

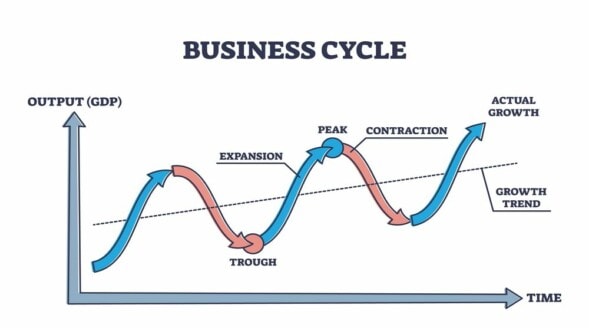

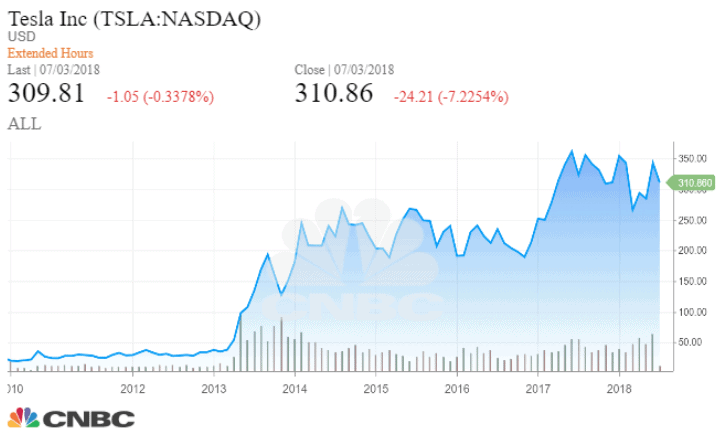

As companies move from an early phase to a mature company it may endure periods of volatility for the stock. Companies mature over time and so does the confidence in their stock. A young company like Tesla is in the stage of maturing to see if the stock will be a long-term investment that many consider to hold. During this stage people don’t depend solely on the financials for whether to hold it. The belief in the company’s products and success they believe is ahead likely drive more of the weight in choosing to own this stock. If it has a similar path as Apple Inc. then the reason to own it over time will change to be based on reliable, recurring company financials.

In the case of both these companies mentioned above you can see that there were different factors we considered. When you evaluate older, more stable companies you will look at factors that affect the likelihood those companies can continue to deliver new and profitable products for years to come. In the case of younger companies that have promising products you consider the likelihood they can push the company into a long lasting stable company. As you evaluate various investments, be careful you don’t fall in love with a company!

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.