[Video] Beneficiaries: Who, When, & Why?

by Stephen Smalenberger, EA / September 6, 2017

STEPHEN SMALENBERGER, EA

In Prior videos we talked about 401(k)’s, IRAs, and even life insurance. Something that we haven’t touched on yet is what happens when you pass away. So what I want to go through here is the big picture to make sure everything is still as you desire. Because sometimes life happens. It goes quick and we forget to update these.

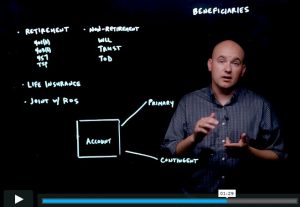

What if I pass away? What happens? Essentially you have an account, and you can name a primary beneficiary, meaning the first person to inherit that account. And you can name a contingent beneficiary, meaning if something happens to that primary person the contingent now receives the account value.

What accounts can have a beneficiary named?

- Retirement accounts like a 401(k) and 403(b), IRA.

- Life Insurance

- Non retirement account where you name someone in a will or on the account as a TOD (transfer on death beneficiary).

- Lastly, if you own an account with a spouse it is known as a joint account and you can have rights of survivorship, meaning that person automatically inherits the account after you pass away.

Who can you name as a beneficiary?

- A family member

- A friend

- Your trust

- A charity

How often should you review your beneficiaries? Checking to make sure you know who your named beneficiaries are should be ongoing. Any time there is a life event like a birth, wedding, divorce, or a death; review these.

Make sure the person you name is still who you desire. You can change this as often as you need, at any point in time during the year. If you have any questions this is something we want to be sure we help you with.

Ready to take the next step?

Schedule a quick call with our financial advisors.