Be Sure to Stay Interested In Your Savings Accounts

by Financial Design Studio, Inc. / May 31, 2018Be Sure to Stay Interested In Your Savings Accounts

How excited have you been to see on bank statements that you’re earning .0010% on the cash in your savings account for the past several years? If you’re like many people it doesn’t excite you to see the small dollar amount that computes to. During this time we have heard warnings and welcome for higher interest rates. So this week we are going to touch on why you should stay alert to the interest rate you earn on your cash savings, including money saved in an emergency fund.

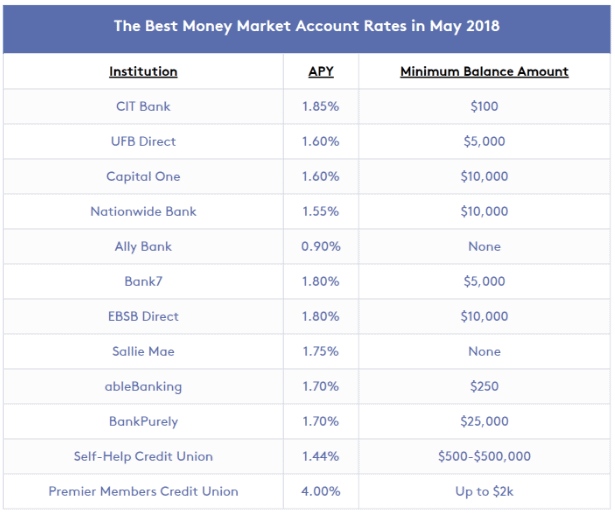

Here is a snapshot of current interest rates available to you in a money market account. These are certainly more attractive and will continue to inch higher as the Federal Reserve raises rates.

So why does it matter that you pay attention to the interest you earn on your savings?

As we’ve explained before in our video on What to do with my paycheck it is important to keep 3-6 months of living expenses in an emergency fund. We hear frequently from people who don’t just want that money sitting idle as it’s being kept “safe”. So this is good news! But if you aren’t careful you will miss out on the interest you could be earning. It’s important to take advantage of these higher rates now that they are available so you are earning as much as possible on these assets that will be there in an emergency.

Be Aware of what’s required to get these higher interest rates.

You need to pay attention to any of the minimum funding requirements or limited number of transactions with any of these accounts you choose to use. Companies like Sallie Mae, Capital One, and Ally Bank are well known for their higher interest money market funds. However, some of the newer money market funds, not those mentioned above, may have lower fees but require you to only function with online banking and no access to anyone when help is needed. This may be fine if it’s how you handle your finances, but just be aware of this, since the funds are meant to be available when that emergency does arise.

It could be a great idea to keep your emergency funds in a higher earning money market account and then the cash you need to function day to day in your bank account. The great part is many accounts can be linked to one another so quick transfers between the two are possible. So don’t just ignore the cash you have saved…it can be working for you too.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.